How a simple change allows dozens more intraday trend winners to come to you when day trading with Ichimoku Cloud

March 18th, 1925.

It was almost as though it was thumbing its nose at God himself as it made its path of endless destruction.

Three states. 695 fatalities. Billions of dollars in damage.

Now it’s known simply as the ‘Tri-State Tornado’. The deadliest tornado in United States history. Meteorologists would spend decades trying to sort out exactly what weather conditions could have fueled such a destructive twister. It wouldn’t be until 2013 before it was fully figured out.

By then it was too late.

When the market goes on a deadly tear, you can be sure of one thing… just like the ‘Tri-State Tornado’ — some poor trader is getting ruined. While it might not be a life-or-death predicament — being on the wrong end of a trending market is one of the most costly errors an amateur trader at any level can make.

Here’s the flip side: While millions of amateur trading accounts are leveled in the path of a trending market, there are traders in the know that are profiting all along the way. The sickening truth of the matter? They aren’t using fancy indicators or complex algorithms to ride these trends.

Nope. They’re using a timeless strategy that’s available on just about every trading platform. Renko bars and Ichimoku clouds.

This approach to trading requires debunking some of the biggest misconceptions in the market today. You simply have to be willing to see the market differently. By ‘differently’ we’re not talking about complexity. We’re talking about simplicity.

Clarity.

Free from the distractions of clutter.

This simplicity and clarity starts with getting rid of one of the biggest distractions that 99% of traders are fixated on… price.

Chapter 1:

Why Time-Based Candles Cloud Your Ability To See Price Action Trends

When a tornado is tearing through a town, nobody seems to talk about the temperature — or the humidity — or how hot it was at the same time last year. Somehow it just doesn’t seem to matter when cows and cars alike are flying through the air.

The same is true when the market decides that it’s going to go on a massive price rip or dip. All the nuances, the grace notes of each tick, the dainty little patterns that your expensive indicators are supposed to be picking up? They get crushed in an instant. No questions asked. Just crushed.

When price is crushing your position and carnage is flying through the air in a real-life market tornado — one single harsh reality comes to light.

Watching price and time together is the biggest waste of time on earth.

And really, if you have a sound trading strategy… who cares where price is at during any given time? Or during any given candle?

Does it really tell you anything? Not really? Does it matter if it breaks a new high? If it busts through a new low? Maybe for your 401K or that indexed fund that your financial advisor put you in.

But not for your trading. Let’s cut to the truth. Watching price and time is not only a massive waste of energy — it’s a huge hindrance to finding good trades.

Why? Because it creates a ton of useless noise.

Despite this, millions of amateur traders around the world do nothing but watch charts that are based on time and price. They load up their charts with price-based indicators that are often late — or just simply wrong — all the time.

What are they, or even perhaps you, missing?

Simple: It’s not price over time that you need to be watching… it’s real price movement. And if you’re looking at a time-based candlestick — you’re overlooking one of the massive drivers that fuels any market on earth — the institutional buy and sell activity that drives any major price move.

[Readers Note: If you’ve unsuccessfully tried intraday trading with Ichimoku in the past, this eBook is for you! Time-based candlesticks are often the first mistake. The noise created by time-based candlesticks results in false entries that can be crushing. Learn how to use Ichimoku cloud like never before right now.]

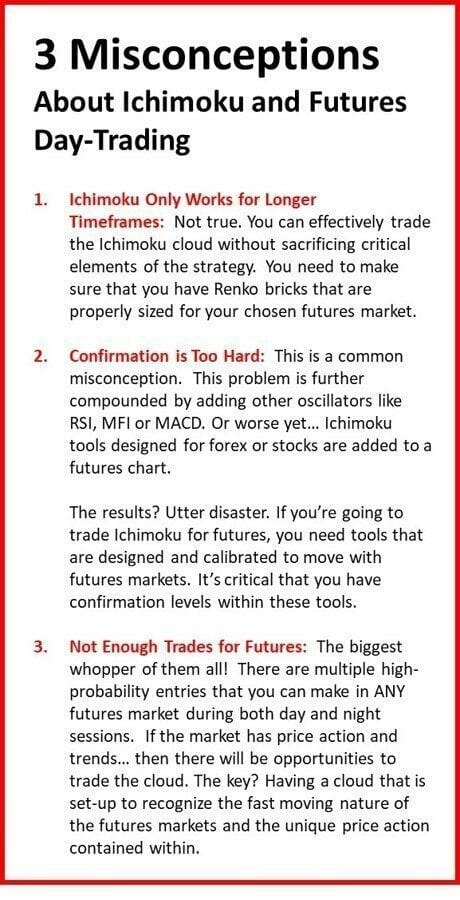

But that’s not it! There are a number of misconceptions, or misguided approaches, to trading futures with Ichimoku that many traders fall for. (Check out the ‘3 Top Misconceptions Box Below’)

Fortunately, you can change this with one incredibly simple change to your chart — and an even easier strategy that will bring joy and profitability to your trading.

“One change to my chart… and one strategy?” We get that question all the time, and yes, you are reading that right. Even better, it will help you filter out the market noise that clouds the clarity of great trades.

First, let’s deal with your chart. Let’s get rid of all those indicators. ‘Clear that palate!’ as a fine wine sommelier would say.

And those time-based candlesticks? We’re going to swap them for Renko bricks.

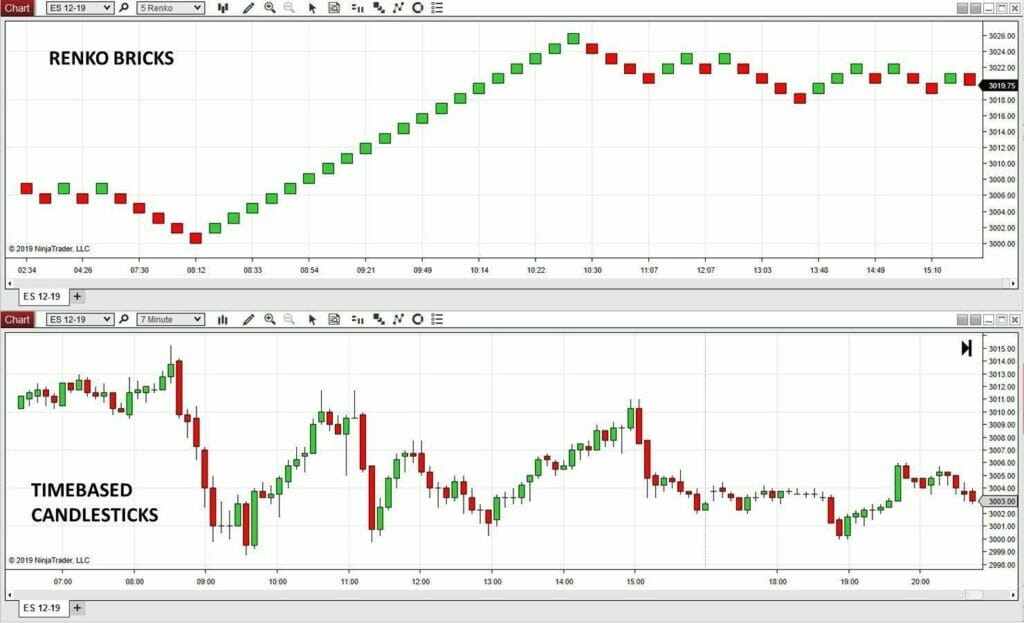

That’s right — Renko bricks. Instead of looking at a market through the lens of time and price… which doesn’t tell you much…

… You need to start looking at the market from the perspective of direction and movement — which Renko bars help you do.

To break it down if you’re not familiar: Renko bricks (or boxes) can be set to various price or movement blocks. So for instance if you set your Renko bars to 50 ticks on a futures market, or however many pips for a forex market, a bar will only form when price has moved in that direction — by that amount.

Why is this helpful?

Because being able to see the price movement as it reaches these thresholds makes it way easier to spot trends. The larger the Renko brick — the larger the price movement — the greater your confirmation is.

While the rest of the world is watching time-based candles, wondering where on earth the market is going — you can simply watch the progression of Renko bricks and let the simple picture that the chart paints be your guide.

If you’re not sure, just take a look at the above ES example. This is for the same exact trading period. The traditional time-based candlesticks look like the EKG of a patient that’s going into cardiac arrest.

Renko? Now that looks like a trend you can trade.

All we have to do is add two simple tools and an easy-to-follow process — and we have a time-proven formula for cranking out profits.

Chapter 2:

The Simple, Yet Powerful Beauty Of Ichimoku

How many times have you stood in front of your television watching the weather man wondering out loud… ‘I wonder if he’s going to get it right this time?’ Or worse yet, you’re headed for a vacation or a business trip and you’re trying to pack for the weather — but have no idea if it’s going to rain or shine.

And how many times has the weather man just been flat out wrong?

Take that feeling and multiply it by 1000%. Add to it a sickening feeling of dread that the market ‘forecast’ or ‘pattern’ that you’re watching and trading is about to cost you money. If you’ve been trading for any amount of time — you likely know that horrible, sinking feeling.

This is exactly the hopeless sense of failure that drives many traders straight out of the market with crushing losses and their tail tucked between their legs.

It doesn’t have to be that way. Look, we already know that if we stop watching time-based charts and swap them out for price action Renko bars — we can dramatically change our perspective.

Now the table is set for the simple, yet powerfully beautiful addition of the Ichimoku cloud. Just to say — it is fun. To trade it? You’ll be bowing your head with deep respect in no time once you see how easy it is.

First, the basics on Ichimoku and how to use Ichimoku cloud.

This is a trend identification and trading system. Plain and simple.

It helps you identify — and most importantly, confirm — price action trends that you can enter and profit from. The elements of the cloud are very simple to understand and the rules for entry or no entry are very easy to follow.

The cloud itself is fueled by moving averages which create bands that will give you reliable support and resistance levels.

The cloud was first developed during the late 1930s by a journalist of all people. That’s right, a journalist — named Goichi Hosoda — came up with this.

Rest assured however, in case you’re having doubts — it underwent 30 years of refinements before the technical indicator was released in the ‘60s for use by other traders.

Unlike other trading signals or systems, Ichimoku is different in that it not only provides entry confirmation — but it also provides the strength of the entry conditions for your evaluation. In addition to confirming a trend — it will also help you understand the momentum of that trend.

All of this can be analyzed and confirmed in about two seconds, simply by looking at your chart.

You can forget all those indicators that you’ve added to your chart.

With Ichimoku you’ll roll into your trade using two tools:

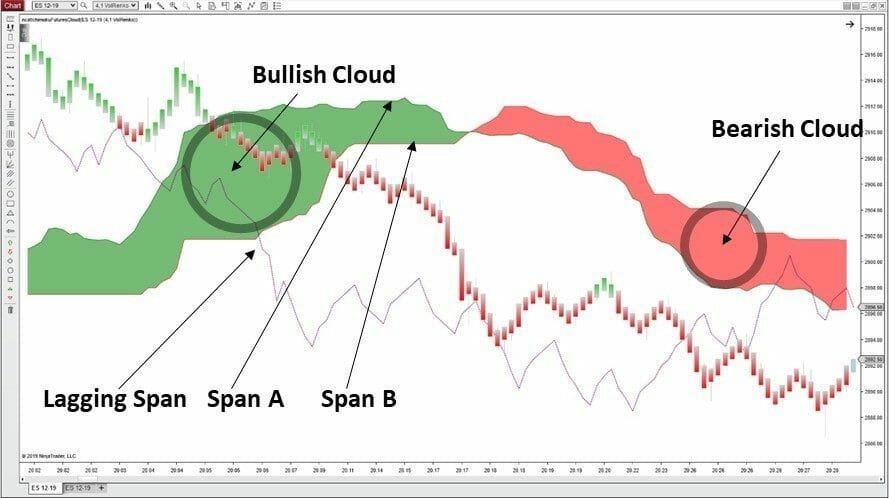

- The Cloud: Consisting of the top band, known as Span A… and the lower band, known as Span B — the cloud will expand and contract based on price action and the strength of any trend.

- >> The wider the cloud — the stronger your support and resistance levels are going to be.

- Lagging Span: This is the primary cross-reference point with the cloud. Think of it as your confirmation tool to verify the conditions that you see in the cloud. The Lagging Span will help you visualize the relationship between current and prior trends so that you can spot potential reversals.

- >> If price is above the Span – you have bullish conditions

- >> If price is below the Span – you have bearish conditions

Check out the above ES example with all of the Ichimoku elements added. No clutter. Just two indicators with Renko bricks.

The beauty of the system? The two work in concert with each other to provide crystal-clear trade entry confirmation and exit warnings.

The rules for entry and exit? As easy as watching the cloud…

Chapter 3:

Cloud Conditions That Lead To Successful Ichimoku Trend Trades

If you’ve given up on weather forecasts altogether and prefer to simply work with the reality that you’re faced with outside — you’re a perfect candidate to trade Ichimoku. Why? Because this simple system is based on trading exactly what the market is giving you.

Not the market that the talking heads on TV are predicting. Not the one that your price action indicator is waiting on.

Nope. None of those. We’re talking about trading the very market that’s unfolding right before your eyes. It makes life easier. And it also makes consistent profits more realistic.

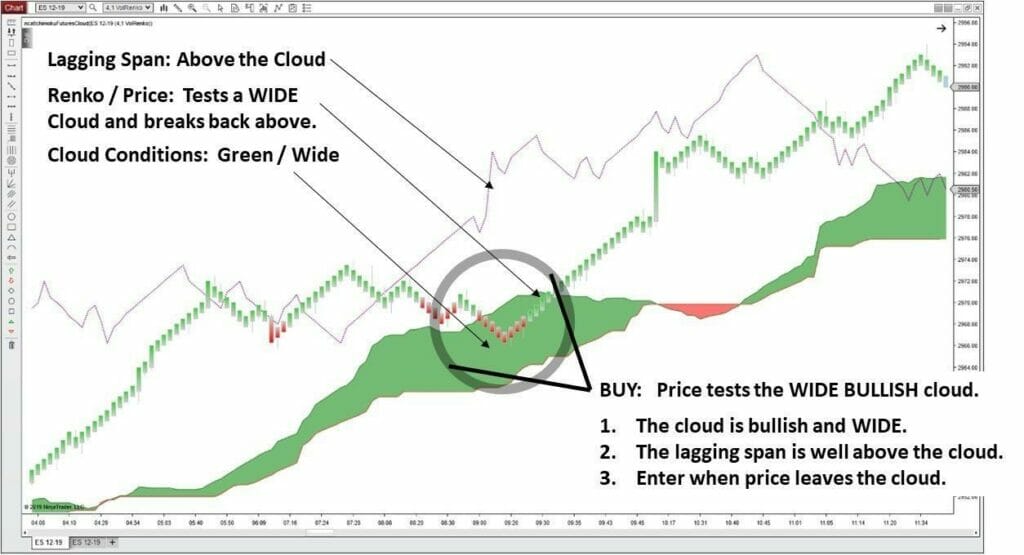

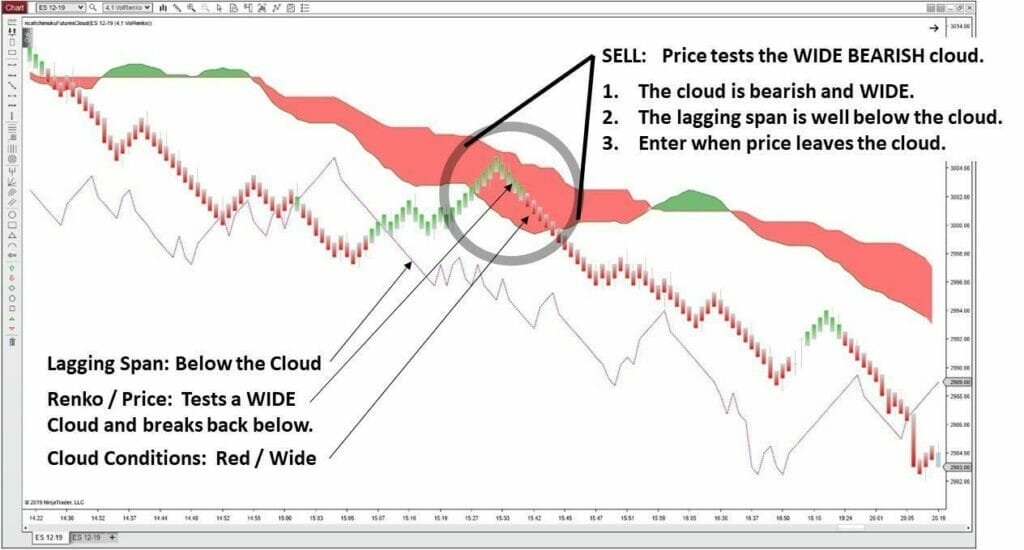

Simply put, your entry conditions can be broken down into two simple rules:

Buy: If price breaks above the cloud when it’s WIDE AND GREEN and the Lagging Span is ALSO ABOVE the cloud.

Sell: If price is below the cloud when it’s WIDE AND RED and the Lagging Span is ALSO BELOW the cloud.

In addition to clear entry conditions, Ichimoku also provides clear rules for trading conditions that you need to steer clear of if you’re looking to ride a trend. Recall that the system helps identify trends — but also measures the strength of a trend.

As a result, if it seems that the market is indecisive — or that a trend can’t be sustained — Ichimoku will signal that for you.

Here are the basic conditions to steer clear of:

- Cloud Crossover: When the Lagging Span is crossing over the Cloud on both sides — or price is running through the cloud with ease.. This means that there is market indecision.

- Thin Cloud: If the Cloud isn’t wide you simply don’t have the strength to provide the support and resistance you need to keep the trend moving in the desired direction.

- Lagging Span Position: Remember that the Lagging Span is your confirmation point. You need it either well above or well below price and the cloud. If it’s venturing too close, crossing or even touching the cloud — simply steer clear.

Amazingly enough, many traders still find the principles of Ichimoku a bit difficult to follow. Perhaps it’s the shifting nature of the cloud or understanding the false signals that can sometimes surface.

If you’re asking yourself… ‘Okay, if this is so easy, why isn’t everyone doing it?’

The answer is simple. Ichimoku is notorious for giving false, misleading signals. Especially for shorter timeframes and for futures.

Traders will think there is good confirmation — only to find that minutes later they are stopped out of the trade — or that their exits were impossible to pin down.

After all isn’t that the age-old question with trend trades? When to exit?

Fortunately, there is a fool-proof system available that provides clear confirmation points for both entries and profit targets. These confirmation points work in concert with the lagging span and the cloud.

They are based on historical and projected institutional trade levels. Which is critical, because if you are going to profit with Ichimoku consistently — you need to be trading with those that are driving the trend.

Chapter 4:

How To Confirm Ichimoku Entries And Exits With Precision

If you happen to live north of Dallas, Texas in the border town of Wichita Falls, or just a bit further north in Oklahoma, you’re smack dab in the middle of tornado alley. Beautiful country for sure, but the storms that range across this part of the country are the stuff of Pecos Bill-like legend.

Why? Without boring you with a lesson in meteorology, this is where the warm and cool fronts of the United States happen to converge creating the perfect conditions for epic storms.

During any given summer, ‘tornado alley’ can shift north as far as Iowa and Minnesota. Experienced storm chasers know exactly where to watch, and what conditions they need to stalk for a mammoth twister.

The same is true in any futures market.

There are specific levels at which price can take off in a roaring trend — or simply grind in a frustrating, profit-guzzling chop.

And this is the key to how to use Ichimoku cloud for day trading futures.

If you don’t know exactly where these levels are… with to-the-tick precision… you will be chasing clouds. You’ll be falling for false signals, entering trades prematurely and getting stopped out before you know what hit you.

A simple system can reduce, or even eliminate this problem altogether. It hinges on having clear confirmation levels that work with the cloud.

Check out the below ES example. Here we have our Ichimoku cloud and lagging span. Note the addition of the Confirmation Grid. This dynamic level gives us the reference point we need for clear entry and exit conditions.

Notice how price routinely respects these levels each time they are crossed. Why does price seem to care, even as it’s roaring down to new lows? Because these are the levels where institutional activity is expected.

Not just any activity. Institutional activity. As in, the traders that are driving 90% – 95% of the market’s volume at any given time.

Remember, perfection doesn’t have to stand in the way of greatness. You can have a great trading machine, one that meets the requirements of the market — all while getting your trading business off the ground.

Use these guidelines as a starting point. Change as you see fit. Build the trading computer of your dreams without breaking the bank!

Seeing this allows us to be far more confident about sell entry. Just as important, this allows us to be far more precise about our targets and exit.

As the trend starts to wind down – we know exactly what to watch for:

- Cloud Change: The cloud has been bullish and is starting to get wider — so if price ventures towards it, we need to be prepared to exit.

- Lagging Span Below: The lagging span is still below the cloud, so we stay in, monitoring each confirmation grid point.

- Confirmation Grid At Convergence: The second the lagging span ventures toward the cloud, getting ready for a crossover… we now stalk that exact confirmation grid point for our final exit.

The best part? You don’t have to spend weeks or months watching clouds and lagging spans to get the hang of this.

You can start generating day trading profits right away using this simple, fully-automated system.

It’s called the Ichimoku Ninja.

It combines the key elements of the Ichimoku trading strategy into one powerful, yet shockingly simple system for reliable profits.

- Futures Cloud: You can add a cloud perfectly calibrated for the price action of a futures market.

- Volatility Renko Bricks: Forget having to figure out exactly what settings you need to have your chart reveal a trend.

- Confirmation Grid: Finally, the vital trade confirmation points you need to manage your entries, targets and exits with confidence.

These are three vital components that will put profits within reach — regardless of timeframe or preferred futures market. And they come with step-by-step video tutorials and guides to creating chart templates.

It’s time to crush the misconceptions that have held traders back from how to use Ichimoku cloud to generate futures day trading profits. Add the tools you need to take the guesswork out of cloud entries and exits.

Simplify your trading and start profiting with Ichimoku today.