Why NinjaTrader®?

Not all trading platforms are equal.

When it comes to NinjaTrader®, there isn’t much that we haven’t seen, tried or heard. Yet, for many traders, this amazing platform is a bit of a mystery.

In a sea of trading platforms, indicators and brokers — how do you decide the best fit for your trading style and experience level?

It’s with this thought in mind that we decided to take a look under the hood and break down every aspect of NinjaTrader®.

We looked at everything. We compared it with our own extensive experience and NinjaTrader® resources. And then we talked to our universe of traders. We are pleased to share the results, which include the good, the bad and the ugly.

Here’s the bottom line:

If you’re a Futures or Forex trader at any level, there are plenty of tools, features and add-ons that can deliver a real-time trading edge. But none like NinjaTrader®, in our humble opinion.Let’s start with an eyes-wide-open review of the primary strengths and weaknesses — something you should always know beforeyou start trading.

Pros

Great Risk Management. Ability to add and dynamically manage targets and stops.

Scalper Friendly. Workspaces and tools (both default and add-on) work well across different timeframes – especially 1 and 5 minute.

Wide Range of Add-ons. Thanks to a friendly developer platform, Futures and Forex traders can choose from thousands of tools.

Easy Chart Management. Tab system allows you to quickly monitor different instruments and strategies with ease.

Free Demo. Traders at any level can try with a demo account.

Broker Selection. Unlike other platforms that are beholden to one broker – you can choose from several different brokers.

Customer Service. Even though there is a steep learning curve (see cons) – there is a wide array of support resources and a very supportive/attentive customer service team.

Cons

No Options Functionality. If you trade options, you’re out of luck with NT. There’s nothing that you can use for options trading analysis.

Learning Curve. If you’re new to trading, it can take a few weeks to fully master the tools, features and chart operations.

Cost. Compared to other platforms and broker fees, you’ll find that NinjaTrader® will cost a bit more per round-trip trade.

Desktop Requirements. If you’re using any third-party add-ons, especially those that require tick replay – get ready to make some upgrades to your PC.

Stocks. Even though you can track individual tickers, the system is not conducive to stock trading (and it’s a bit more expensive).

Limited Research. More geared for technical analysis — fundamental market data, robust news feeds and historical research resources are very limited.

Mobile. Unlike other platforms, there are no plans for mobile or web-based accessibility.

Out of the Gates: Default Indicators

If you’re a candlestick purist – NinjaTrader® comes loaded with everything you’ll need. There are over 100 indicators that will suit traditional support and resistance, scalping and position trading.

Simply put, if you’re just looking to take advantage of basic chart patterns and price action… you won’t need to spend a dime on add-ons. You’ll also find that the default indicators are often BETTER than their expensive counterparts.

At-A-Glance

- 100+ Default Indicators

- All Major Indexes, Oscillators and Channels Included

- Easy to Add & Adjust

- Simple Mix & Match Settings

Popular Default Indicators: Futures

INDEXES & OSCILLATORS – Looking for extreme price conditions? Choose from over 15 default oscillators.

MONEY FLOW – Thanks to a partnership with Chaikin Analytics, three indicators come free within the default indicator lineup.

CHANNELS – Trading the bands for bounces? Add as many as you like across Keltner, Bollinger and Regression channels.

VOLUME – Looking to confirm market pressure? NinjaTrader® has a wide array of default volume indicators to choose from.

Popular Default Indicators: Forex

Simple Moving Averages – Looking for basic crossovers? Set them up in seconds across different periods.

Momentum – Want to know when buyers or sellers are picking up steam? Simply watch the range.

Relative Strength Index – Sick of falling for fake reversals? Confirm swing strength at a glance.

Regression Channel – Scalping intra-trend reversals? Spot entries in advance with a simple channel

Supporting the default indicators is a full suite of chart customization tools. If you’re very particular about the appearance of your chart and the presentation of your indicators, you’ll have every option imaginable.

Additionally, if you collaborate with other traders – or like to make notes, lines, or are inspired to create full-blown Picasso on your chart – you’ll have everything you need.

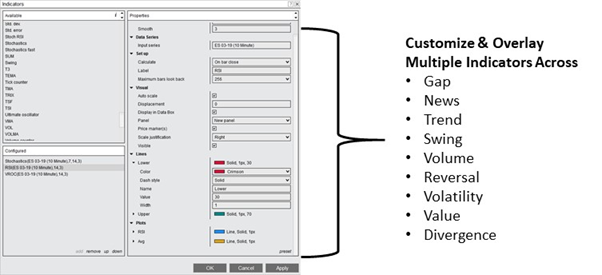

Secret Sauce: Add-On Indicators

Looking for an edge? NinjaTrader® has a plethora of add-on indicators that can be bought and added with easy set-up. These indicators allow you to see inside the candle, stalk price extremes, and plot solid entries and exits.

The indicators are easy to find and easy to add. Although you may find the visual interface of NinjaTrader® to be somewhat cumbersome (multiple windows that look like they come from the Al Gore era) – you’ll find that the mechanics are solid and easy to master.

Many retail traders don’t realize that the open platform on NinjaTrader® makes third-party application development easier. The value to you as a trader? You’ll have plenty of custom solutions to choose from.

Want to develop your own indicator or trading strategy? NinjaTrader® boasts one of the world’s best developer forums as a starting point.

The second you finish installing the standard edition of NinjaTrader®, you’ll have your pick of over 1,000 add-ons.

| Indicators | Strategies | Asset Classes |

|---|---|---|

| Automated Strategies: 61Chart Styles: 17Drawing Tools: 9Indicators: 327Market Analyzer Add-Ons: 5Trading Education: 71 | Chart Patterns: 21Divergence: 28Fibonacci: 18Market Profile: 35Order Flow: 49Support/Resistance: 105 | Futures: 317Forex: 261Stocks: 244 |

MOMENTUM – Instantly detect directional momentum to pinpoint high probability entries & exits.

TREND HEAT MAPS – Easily determine if a REAL trend is kicking in or if price is simply rebounding.

BOLLINGER MACD BREAK MOMENTUM – Eliminate buying or selling into sideways markets by confirming direction early

DAY TRADING SIGNAL – Simultaneously scan markets for perfect entry conditions and crazy profits.

NinjaTrader® Pricing Options & Fees

Not sure you’re ready to make a commitment? No problem! You can try NinjaTrader® for free simply by downloading the platform and tying it to the brokerage account of your choice.

After that, you have flexible lease or own pricing options, depending on exactly what out-of-the box add-ons you’d like access to.

Thanks to the advanced tick replay feature, there is now a full suite of Order Flow tools – which allow you to see real-time buy and sell activity inside each candle. This is an amazing set of tools – but ones that you’ll want to ease into if you’re new to NinjaTrader® and new to trading in general.

Here is a full breakdown of the platform pricing options – and the features available with each option.

| | Free | Lease(Annual, Semi-Annual & Quarterly) | Own |

|---|---|---|---|

| No Charge (requires a funded account) | Annual: $720Semi-Annual: $425Quarterly: $225 | Single Payment: $1,0994 Monthly: $329 | |

| Available Brokers | NinjaTrader® Brokerage | NinjaTrader® BrokerageCity IndexFOREX.comFXCM (non-US)Interactive BrokersOandaTDAmeritradeCQG | NinjaTrader® BrokerageCity IndexFOREX.comFXCM (non-US)Interactive BrokersOandaTDAmeritradeCQG |

| Advanced Charting | YES | YES | YES |

| Market Analysis | YES | YES | YES |

| Market Replay | YES | YES | YES |

| Simulated Trading | YES | YES | YES |

| Advanced TradeManagement | NO | YES | YES |

| Chart Trader | NO | YES | YES |

| Order Hotkeys | NO | YES | YES |

| Custom App & Strategy Development | NO | YES | YES |

| Enhanced SuperDOM | NO | YES | YES |

| Modify Orders via Indicators | NO | YES | YES |

| Tabbed WindowManagement | NO | YES | YES |

| Auto-Close Positions | NO | YES | YES |

| Volumetric Bars | NO | NO | YES |

| Market Depth Map | NO | NO | YES |

| Volume Profile | NO | NO | YES |

| Volume Drawing | NO | NO | YES |

| Trade Detector | NO | NO | YES |

| Cumulative Data | NO | NO | YES |

| VWAP with Deviation | NO | NO | YES |

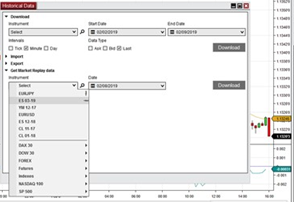

Market Replay: Practice Makes Perfect

The Market Replay feature is one of the most beloved capabilities offered by NinjaTrader® by traders at all levels. This allows you to replay and practice simulated trades using historical market data – tick by tick – fully synchronized across the platform as if it was happening in real time.

This allows traders to revisit specific periods of market volatility – like FOMC or the Jobs Report – and hone their entry and exit strategy. If your trading and practice time is limited due to a full-time job, this feature allows you to replay an entire day’s worth of market activity and practice your strategy, or work through your educational content.

Replay any market and any timeframe – tick for tick – to hone your strategy and perfect your trading.

NinjaTrader®’s playback function works just like your TV. You can record market activity during the day, and watch (or trade) in a simulation environment when it’s convenient for you.

Unlike other products that only allow you to replay one market at a time, NinjaTrader® provides synchronous replay of any and all recorded markets – and delivers the market data to all NinjaTrader® windows. Just as though you’re trading in a live market.

This also means that you can have multiple SuperDOMs and charts running at the same time. Even better? You can replay the market at different speeds. Now if only NinjaTrader® could find a way to slow the actual market down… and add a rewind button during live money trading… that would be truly awesome… ?

Considering the purchase of a high-priced indicator? One that boasts a high win rate and a ‘surefire, lock-and-load, rack up profits’ approach to trading? Backtest that bad boy easily by letting it run in simulation. Or better yet, take it out for a test drive in Market Replay where you can see just how ‘easy to use’ that indicator really is.

Have an existing strategy or indicator that you’d like to test? Same deal. Take advantage of NinjaTrader®’s paper trading and market simulation to work the bugs out before you trade live money.

Ask any training pro and they’ll tell you that practice in simulated trading environments is the biggest barrier to success that many traders face. Take advantage of Market Replay to beat your trading demons!

Inside Track: Hidden Hacks & Tricks

Think of NinjaTrader® as an old Victorian mansion. Something straight from the game of Clue. There’s the grand foyer (the charts), there’s the billiard room with the cognac and goodies (indicators)… and then there’s all the hidden passages where the real story lies.

Welcome to the hidden hacks and tricks of NinjaTrader®. These are the hidden hallways and revolving bookcases within the platform that can make your passage to consistent profits much easier.

While there isn’t a published map to all of these hidden hacks and tricks, you can lean on a partner to show you the way.

What are you looking for in a partner? Someone with a deep and extensive history on both the educational and development sides of the NinjaTrader® platform.

The team at Ninjacators has been working with the NinjaTrader® platform in both capacities for the better part of a decade. In addition to an extensive array of easy-to-afford indicators, they’ve pulled the curtain back on many of these hidden hacks and tricks.

If you’d like to see more, check out this video…

Fueling the Platform: Data Feeds

NinjaTrader® comes with a wide range of data sources, although there are three primary data providers that most traders lean on.

Each comes with a slightly different price point and customer support capabilities. Kinetic is the most frequently used, although all three are considered to be comparable.

If you’re new to selecting data providers, it’s best to test different feeds with your system and your trading strategy.

For instance, if you’re scalping and looking for precision entries and exits – you’ll want to fine tune your charts, indicators and data feed in a free simulated environment first.

NinjaTrader®’s tab and window system allow you to view several markets at a time – but this can also impact the performance of your incoming data feed. Specifically, the speed and rendering of the bars can be affected as you cycle from one view to the next.

Want to ‘stress test’ a data provider to see if it’s right for you? Turn on tick replay and run multiple short-term charts with Order Flow turned on. Add long-term (301+ days) charts with detailed volume profiling added.

You’ll find that if your system can support both without data feed hiccups or regular interruptions (crashes), you’ve got an optimal pairing.

Futures

Powered by CQG, Continuum delivers low-latency connectivity to the futures exchanges.

Monitoring: 24 Hours

Customer Support: 24/7

Cost: Starting at $110/MonthFree Demo: NO

Stocks, Futures & Forex

The preferred real-time quote & historical market data service optimized for NinjaTrader®

Monitoring: 24 Hours

Customer Support: 24/7

Cost: Starting at $60/Month

Free Demo: NO

Global & Regional Markets

Industrial grade, low-latency data used typically by large trading houses and hedge funds.

Monitoring: 24 Hours

Customer Support: 24/7

Cost: Broker RelatedFree Demo: NO

Additional Market Data Providers for NinjaTrader®

Coinbase

Total Cryptos (Crypto-currency)

eSignal

Ostrader (China Stocks & Futures)

TradeStation

IQFeed

Portara

Cedro (Brazil)

Global Datafeeds (India)

True Data (India)

BitMEX (Bitcoin)

Lenz & Partner (Germany & Europe)

Housing Your Account: Brokers

NinjaTrader® is broker-agnostic and supports a number of brokers across the globe. Choosing a broker is a personal decision tied to your account, tolerance for commissions, and customer service needs.

Here is an important note: There is a risk of delay between different platforms. This can impact how entries and exits are filled – especially during periods of heavy volume and high volatility.

If you want seamless connection between the NinjaTrader® platform and the broker… consider going with the NinjaTrader® Brokerage.

| | Futures | Forex | Stock | Crypto | Regulated | Minimum Deposit |

|---|---|---|---|---|---|---|

| FXCM | YES | YES | NO | YES | FCA, CFTC,ASIC,FSA | $50 |

| TDAmeritrade | YES | YES | YES | NO | SEC | None |

| Interactive Brokers | YES | YES | YES | YES | SEC, FCA | $10K |

| GAIN Capital/City Index & FOREX.com | YES | YES | YES | YES | FCA, CFTC,ASIC,FSA | $50 |

| NinjaTrader® | YES | YES | NO | NO | FCA, CFTC,ASIC,FSA | $1K |

| Oanda | YES | YES | NO | NO | NFA, CFTC | $100 |

Trade Management Advantages

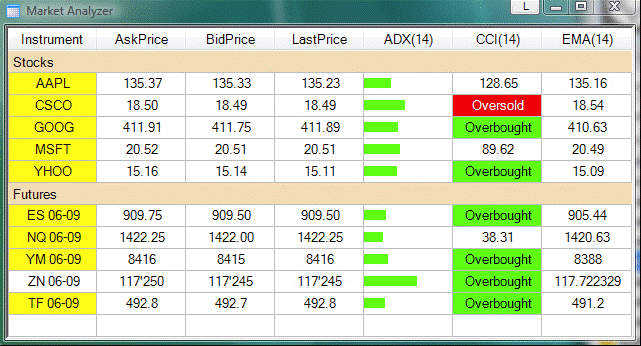

NinjaTrader® is built to help traders at any level locate trades, manage trades effectively – and avoid out-sized losses. Once you have your strategy established and your indicators set, there are some basic capabilities that you should be prepared to take advantage of.

The Market Analyzer allows you to scan as many markets as you like for your ideal trade conditions – in real time. Simply define your criteria, select your markets and let the Analyzer do the work for you.

While your friends are frantically moving from chart to chart – you can sit back as the Analyzer runs in the background. When a market demonstrates the conditions that are optimal for your trading strategy, the Analyzer will flag it for you for further inspection.

You can add over 150 indicator columns and dynamically rank, sort or filter market conditions as you see fit. Based on the rules that you’ve established, you can select your color codes and alerts as desired.

Set your trade criteria and let NinjaTrader® scan hundreds of markets to find the entry opportunity for you!

Advanced Trade Management (ATM) helps protect your account from catastrophic losses. Applied to your chart the instant you are filled, ATM can be dynamically adjusted during a trade as conditions unfold.

Simply set your profit and stop loss targets in advance using rules that match your preferred risk/reward ratios. Depending on your trading style, you can set up multiple ATM presets and selects based on the strategy that you’re currently working with.

ATM is conveniently housed within Chart Trader, providing fast and easy access to adjust settings and turn the feature on during live trading.

NinjaTrader® even supplies strategy templates if you’re not sure where to start. This feature alone creates the following trading advantages:

- Eliminates Emotion: The settings are applied immediately for you, without the struggle that comes with determining a target or stop.

- Faster Orders: Orders are submitted at PC speed instead of human speed, allowing you to grab profits, or stop losses the second ATM levels are touched.

- Consistency: With ATM, you’re entering and exiting with the same criteria – which creates consistent results that allow you to troubleshoot your trading – or scale your success.

Unlimited Potential

Your trading platform won’t give you profits… but it sure can take them from you when you least expect it.

There’s a reason why professional Futures and Forex traders prefer NinjaTrader®. Its scalable, easy-to-master platform can bring efficiency and confidence to any trader at any level.

There’s an entire community of users, developers and brokers that you can lean on for support, education and additional resources.

Consider NinjaTrader® from the perspective of an institutional trader, with billions riding on every entry…

To deliver the results that they and their investors are looking for – they need the precision, resources and partners that can only come with NinjaTrader®. They need access to data that gives them an edge.

More than anything? They want an environment that they can customize as they see fit, using a platform they can count on, with tools and data that will give them an edge. NinjaTrader® delivers all of that and then some.

Put this powerful platform to work for your account today.

5 Reasons To Download NinjaTrader®

1. Better Trade Control.

Seconds and minutes matter. NinjaTrader®’s platform and tools give you greater control for precise entries and exits.

2. Valuable Add-Ons.

They aren’t gadgets. They are fully integrated indicators that professional traders use to gain an edge in the market.

3. Proven Partners.

Brokerage and data providers are industry pillars with solid customer support and reliable regulatory oversight.

4. Superior Trade Management.

Advanced trade management tools directly on your chart help you seize market opportunity while managing losses.

5. Support Resources.

If you’re concerned about the learning curve, take advantage of the vast educational resources, market replay, and free (unlimited) demo period.