Don’t let the beautiful surroundings fool you. One wrong move and death is an almost certainty.

Even if the crash doesn’t do you in, it will take weeks to find you in the world’s most unforgivable terrain.

Welcome to the high-stakes task of landing a plane in the Swiss, French or Austrian Alps. You can close your eyes, throw a dart at a map of the region and you’ll be left with an airport that only the most seasoned of pilots can navigate.

While it might not be a life-or-death matter – navigating earnings season often means the end for many accounts. The vistas that share price makes are breathtaking. The opportunities for profit are too much to pass up.

Yet many traders simply clear out their account the second news comes out. You can trade guidance announcements with confidence. You just need a solid strategy, patience and a good market map.

Appealing, but deadly, times to land a trade

Innsbruck, Austria. Among the most difficult airports to park a plane in the region. The first officer isn’t even allowed to take the controls – it has to be the captain. Why? You’re basically coming into a valley with mountains on every side and low-level wind shears. Everywhere you turn, there’s danger waiting.

The same is true during earnings season. Positive news can be seen as negative by the market driving price down. Negative news can be seen as a bargain driving price up inexplicably. And just when you think you’ve figured it out – nothing happens when earnings come out as the market simply shrugs.

It’s almost like there’s an invisible force that’s driving share price – a force that no one can predict.

Despite the dangers, millions of retail traders circle earnings announcements on their calendar waiting to cash in every quarter. They watch the consensus forecasts, read the analyst reports and stake their position without batting an eyelash. Why? Because hard work, research and commitment will lead to profits – right? Unfortunately, that’s wrong.

In reality, everything you’re reading about leading up to the announcement is already reflected in share price. It’s called, ‘efficient market theory’. You don’t need a PhD to understand efficient market theory. It basically means that everything that can be publicly known about a stock is already reflected in the share price.

This includes sales forecasts, and new products set to come out. It reflects the perceived future value of the stock – not just the present.

The only thing that will likely change price? Enough for you to have a shot at profit? A guidance adjustment during the earnings announcement. When this happens, everyone – including the institutional hedge fund traders – have to respond. And you can ride shotgun.

What to look for when circling earnings season

When talking about Austria’s Innsbruck airport, a pilot revealed: ‘We get special training every year in the simulator for this airport as it’s especially challenging… possibility of heavy snow, strong winds and a short runway.’

Not exactly the makings for a smooth ride. When trading during earnings season, you can strap yourself in for profits regardless of whether the news is good or bad. This is because, instead of jumping into the fray and panic that takes place before the news comes out – you can sit back and watch.

That’s right. Sit back and watch. In fact, you may consider fully detaching yourself from that favorite company and taking a more clinical approach that allows you to look across multiple stocks at the same time.

Ok, fine – who likes drama anyway? So what are you looking for? Simple. You’re looking for surprises. One thing you can count on with high probability? The market hates surprises. A ticker facing an earnings surprise tends to stand out like a sore thumb.

It’s these tickers that give you the starting point that you can zero in on, and stalk for a potential trade. All you need is a solid screening tool, usually provided by your broker, and a pattern to watch for.

A basic strategy for landing in any earnings condition

When flying in the Alps, the conditions and flight path – especially for landing – is evaluated visually. No autopilot here. There is a beating heart and decades of experience guiding passenger flights in for landing in these conditions.

The same applies when trading any event. Instead of flying with an indicator or on the consensus reports to make your trading decisions for you – you’ll need to trade what’s in front of you. Something that most traders simply aren’t comfortable doing.

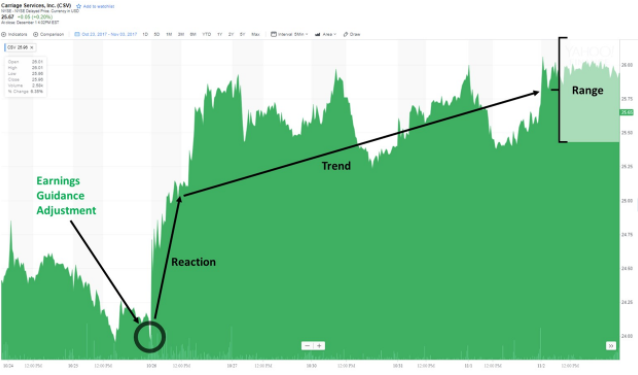

Here’s a great example of a guidance announcement that came out late October. Carriage Services (CSV) released its third-quarter earnings and increase Earnings Per Share (EPS) from $1.73 to $1.77 and its revenue forecast from $273 million to $277 million.

Not a bad announcement – and they happen to come out all the time. Instead of trying to predict price action in advance – or even pin your own valuation on the stock – let the market do it for you. As mentioned earlier, sit back and watch the reaction.

In this case, the reaction is pretty straightforward. The market responds positively – there is a fade as the buyers get out and then the trend marches on to the new price level (where it’s still trading).

In this moment, instead of guessing and panicking – you can watch for the initial surge (or reaction), the sell off, and then the trend that sets in. In the case of an optionable stock – you then have the range that you can use to trade income producing spreads and condors.

Leave the research and guessing to the rest of the trading public. Sit back and wait for earnings surprises and land your trades with confidence and safety.