Eleven crewmen died instantly and the fireball the explosion created could be seen from 40 miles away. It would cost billions of dollars, ruin thousands of lives, and kill countless miles of coast and wildlife before it was all over.

When price in any futures market decides it’s going to blow up — the last place you want to be is in a trade that’s burning to the ground. Yet that’s exactly where millions of amateur traders find themselves — every time.

And it doesn’t all go down in one trade. It happens with one price explosion after another. And they’re all painful. Assuming your account survives, you’ll have scars that will impact your trading forever.

Making matters worse, you know that someone is profiting every day from these explosive price reversals and continuations.

So trade after trade, entries are made and the account keeps burning.

The truth? You could be profiting as well. All you need to do?

Change absolutely everything you’re doing when it comes to price action continuations and reversals.

What most traders don’t know about price explosions

Things went haywire at 9:45 on April 20th in 2010. It was the final stages of drilling when a geyser shot up from the marine riser and onto the rig — shooting up 240 feet into the air. What followed is referred to as an ‘eruption of a slushy combination of drilling mud, methane gas and water’. Forget the chemistry — it was a total firestorm.

Every minute there’s a slushy, methane-like explosion in a market that has traders jumping in and racing to make an entry.

These are usually the moments when news hits, or volume spikes and price loses its mind — even if it’s just for a moment. Traders are often burned badly with losses during all stages of the explosion.

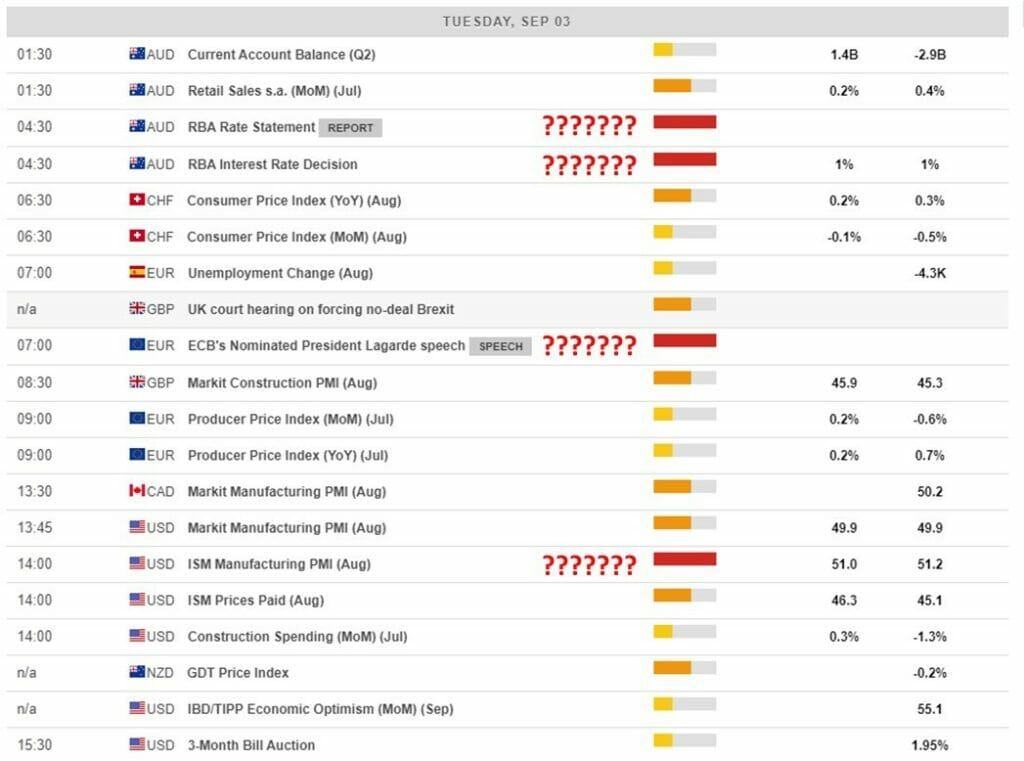

Opportunity for profit or catastrophe? Stop relying on the unpredictable volatility that comes with every week’s economic calendarThose who try to trade in advance — get burned by being wrong.

Sure, intentions are always the same. We hear it all the time: “I’ll just get in for a few quick bucks and if it doesn’t go my way, I’ll bail.”

Like Deepwater Horizon, this logic is usually founded on a shaky platform of planning and location plotting.

The losing process is pretty much identical around the world:

- Economic Calendar: This is the source of all riches and volatility right? You simply check for the big red reports and cash in? Right? I mean right? No. Actually this is a FANTASTIC WAY TO LOSE.

- Support & Resistance: You play the YouTube video about fractals again and head to your charts imbued with a fresh sense of confidence and optimism. Suddenly support and resistance levels abound. You see solid-gold, sure-fire ‘locks’ all over the place.

If you’re thinking right now… ‘Well this is why I have a spiffy indicator to do all of that work for me’… Think again. Price action indicators are hopelessly late. Not just some of the time… try all of the time.

Why? Because they don’t factor the historical volume that precedes price action at these explosive levels.

No, in order to profit from explosive price patterns — you need to throw away these wasted planning traditions.

And in reality, it doesn’t matter what pattern you’re looking for. Bull flag, symmetric triangle, head and shoulders… any of them.

If you learn to apply this three-part formula, you can turn these patterns into consistent profit machines.

Eyeballing support and resistance can be tough. Stop second-guessing and use volume to start guiding your entries!

An indication you need to watch when price blows

The crew did everything they could, including activating the blowout preventer — but it failed. As it turns out, in that situation the final defense to prevent an oil spill is a device known as a blind shear ram. It’s designed to literally shear off the drill while simultaneously sealing the hole shut. That failed as well. At that point you run for cover.

Not the case when you’re looking to make an entry and profit from a standard price explosion. What many traders miss are the critical confirmation elements they need to have in place — before even considering a trade.

These elements are fundamental to any continuation or reversal –– but they are often misunderstood or missed altogether. We can sum them up in three questions that you should be asking before pulling the trigger on any entry when considering a pattern.

- Do I have confirmation on this pattern? Phantom patterns have a habit of coming out of the woodwork… especially when you’re on a losing streak. For many traders, they simply need to focus on fewer patterns and those that are easier to spot.

- Is volume on my side? Volume is the very fuel of price explosions. If you don’t know who’s driving the volume — you are flying blind. You literally have no idea who is fanning the flames of the price explosion. Never attempt to enter or even manage a futures trade without knowing who’s driving the volume train.

- Exactly where am I entering? Is it a zone? Is it a breakout level? Or is your targeted entry to-the-absolute-tick? Many traders play chicken with their entries, playing the second-guessing game of ‘what if, then if’ every time. Doing this means you’re late. And it also comes with the equally deadly habit of not having a clear target.

Here’s a dirty little secret that many traders who are consistently profitable want you to ignore… piecing together these elements is really easy.

Spotting explosions you can profit from

It took a full two days before the fire finally died down on the rig, and then it sunk into the ocean. The remains of the rig were found about 5,000 feet below on the seafloor. They wouldn’t cap the gushing hole spewing oil for almost another three months. The damages were almost incalculable.

You can avoid getting burned by a price gusher in three simple steps — on both explosive continuation and reversal trades.

Here is a perfect day trading example on an ES 5-minute chart. As a side note, the S&P has more explosive price moves than a fireworks show on the 4th of July. But bear in mind… although we’re showing the S&P — it doesn’t really matter what you trade.

This strategy can apply to any futures or forex market for that matter.

Here we have the basic elements you need to take advantage of an explosive reversal. And it all comes to your chart thanks to tools that are already there — and won’t cost you a dime.

- Pattern Confirmation: A double bottom. No mistake. Price barrels down to a level, backs off and tests again. It’s simple. It’s elegant and you can wait on these all day long without thinking much about it.

- Enter with Volume: We’re not betting on the reversal. We’re not guessing. No, we’re entering with the BUY volume at a very specific price point. In this case — 2,905 on the nose. Nothing more. Nothing less.

- Exact Exit Target: Getting out can be a tough move to make. Having volume as your guide — when you’re long you simply need to look for a future increase in SELL volume. In this case, it’s as clear as day.

This is a process you can repeat over and over to take advantage of explosive continuation and reversal trades. You can save yourself the time that you’ve been putting into studying the economic calendar. You can remove all of those notes and lines from your chart.

Start to enjoy your trading again. Start profiting from explosive trends and reversals for consistent profits.