The Snake River Plain in north Idaho. You’ve been waiting in your position for over three hours now and it looks like your patience is about to pay off. About 200 yards out, at the crest of a ridge, an adult bull moose stares right back at you.

Just under 7 feet tall, 1,500 some pounds and antlers that could take out a Buick, this is the prize you’ve been looking for. You can take the shot now, or you can stalk for a higher probability kill. Your mantel has been in dire need of an addition worthy of your ego.

Choices like this face traders in every market, every day — often with shoot-and-miss results — scaring off any profits. There are basic rules you can follow when setting your targets that allow you to bag profits while minimizing risk.

Big game profit targets you should aim for

Many of us have visions of reading the conditions, adjusting for the wind and taking our shot from over a mile away. Bullseye. In the real world, when faced with the prospect of having to earn a living? Who wouldn’t want a closer look with better odds of a kill?

The same is true of choosing your target when planning an entry. Choosing a target that requires an alignment of the stars and every ounce of wind at your back isn’t realistic — or safe.

When plotting your trade, targets that coincide with the terrain of the chart and prior price performance make the most sense. Depending on your time frame and trading strategy, these opportunities are often right in front of you. As long as you know what to look for.

Stalking targets that lead to moose-like profits

A champion long-range shooter will tell you “The most important aspect of being on the range is not to shoot, but to collect data on the rifle”. This prior performance data will give you vital intelligence when sizing up a shot during a hunt.

This same familiarity with your chosen market will help you quickly select targets that make sense once your entry conditions/requirements have been met.There are four basic concepts to start with when locating a target:

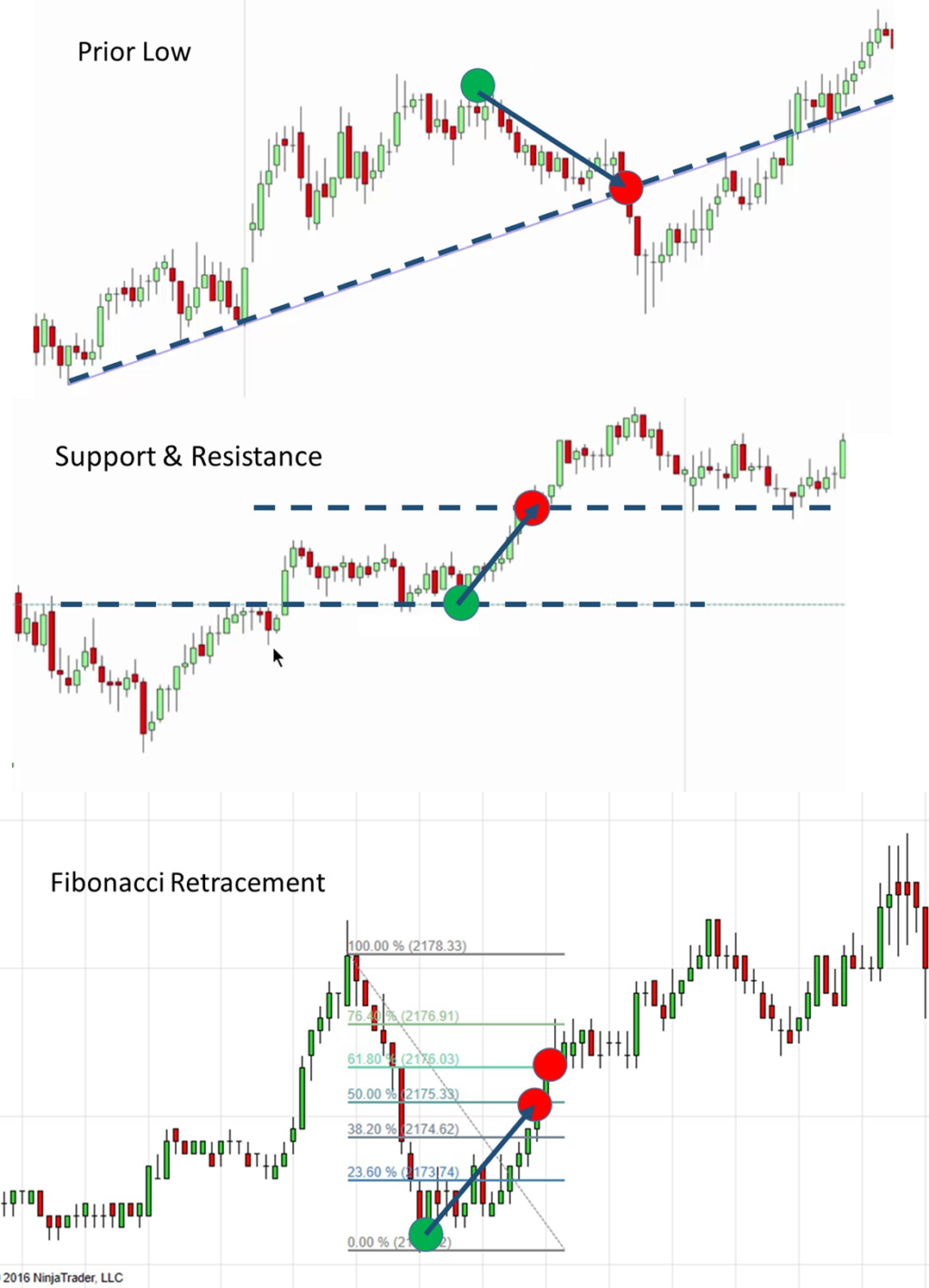

- Support & Resistance: During periods of price consolidation, a clear value zone should emerge with defined edges at the top and bottom. When price approaches one of these edges — you should be on the lookout for a reversal.

- Fibonacci: Extending the Fibonacci retracement tool (of your choice) from a preceding swing will give you levels that will serve as support and resistance. (See our other articles for additional guidance on using Fibonacci retracement tools.)

- Previous High, Low & Close: Prior price breaches at the top, bottom, and at the close of business will serve as potential bounce points to keep an eye out for.

- Daily High and/or Low: The registered high and low for the day are regularly respected as points to watch for support, resistance and reversal.

Logical entries and exits that you can sustain, even if you feel you’re leaving money on the table.

Using any of these as a potential target point can help you cap your trade’s gameplan with an exit that makes sense.

Build your accounts with targets you can count on

Snipers prefer to shoot dirty — choosing not to clean their gun for 200-300 rounds. The practice is called ‘shooting dirty’. Why? Because the barrels will generally shoot more accurately with less deviation.

Choosing a standardized target strategy that doesn’t deviate brings much-needed discipline to your trading regimen. Avoidable risk comes into play when you make changes to your target — mid-trade — without logic or a plan. Unacceptable risk is introduced to your trade (and your account) when you enter into a trade without a predetermined target that can be justified.

Clear targets that you can lean on are a critical part of any risk management strategy. Ideally they keep you in your trade for the minimal amount of time required to meet your profit objectives — and not a second longer.

Choosing actual kills over moose sightings

Often the case is made for taking big shots and aiming for big profits. The alternative is seen as limiting. Leaving money on the table. After any extended period of time, this approach often results in a handful of winners — and even more devastating losers.

Instead of watching big profits pass you by, take home real profits that will build your account.

The YOLO (you only live once) approach to targets is an excellent way to bring excitement to your trading day — and massive losses to your account. Capturing profits within your defined target plan is an approach that you can replicate and lean on over time.

Many experienced traders choose to modify their target plan as their strategy evolves — or as they expand to new/different markets. These adjustments are made using a body of work as a reference and are akin to adjusting the rifle.

Bag big game profits with targets you can’t miss

Long-range shooters will tell you that breathing is a huge part of being accurate. For many, the ‘sweet spot’ is that moment right between breaths, a beat after you’ve just exhaled. The perfect moment when you’re focused and steady enough to take a shot.

The same ‘sweet spots’ can be spotted when setting your targets. Establish the high-low range that price has been oscillating in during that day. As your trade nears that level, plan your exit and take your profits.

Keep an eye on nearby support and resistance. Even if you believe price is going to barrel through, take your profits — and pad your account gradually. This will help ensure a disciplined process that can be repeated over time.

Bag trophy profits with high probability targets your mantel will be proud of.