With five miles to go Atsede Baysa was in fourth place, coming down the stretch in the 2016 Boston Marathon. She was thirty-seven seconds behind the leader, an eternity when trying to close a gap in a long distance race.

As it turns out, the 29-year-old Baysa was just getting started. Finding her final ‘kick’, she revved up to the fastest pace of the race and won with a seven second lead. After pacing herself, she put the pedal to the floor at just the right time.

Order sizes can accelerate your profits, or create a gap with losses that you can’t recover from. Knowing when to scale into a trade, and when to go in big can make all the difference.

A way to manage the pace of the market

If you’ve never run a marathon before and decided you’d give it a shot, the first element the pros will tell you to determine is pace. The rate at which you run throughout the race. For some, it’s the same all the way through — for others it varies based on conditions and race strategy.

As a trader, your ‘pace’ is determined by your trading strategy, and is expressed by the size of your orders and the frequency of your trades. Set price or volatility aside, these two factors alone can make or break your account.

Order sizing has two primary components — order type and order size. The order types of standard, mini or micro have mostly to do with your available capital and the account configuration you’ve agreed to with your broker. Order size is a factor that all traders must use effectively throughout their trading day.

Once you’ve located your trade and are about to make your entry, it’s time to decide if you’re going to sprint to your goal or ease your way in. Multiple contracts upon entry can represent either an all-out bet or a calculated risk. Assuming a position with one contract can be considered safe, with maximum flexibility to add more — or a forfeiture of profits.

An approach to trading that helps you finish the race

For many, training for a marathon starts with determining your base pace. The minimum speed at which you’ll need to run to finish, to meet your objective/goal. Once you’ve established that you can sustain your base pace, you’re ready to add ‘kicks’ or sprints. The benefit of having both: You can manage a race to meet your goal based on the conditions that confront you.

The same is true in trading. Regardless of your chosen market or account size, you need to establish that you can meet your ‘base pace’. Bear in mind that establishing your base pace means not only projecting your desired profits, but also forecasting the losses you’ll encounter.

Once this has been established – you’ll likely find that you need to throttle your order sizes up and down. There will be moments where it’s appropriate to be aggressive, and others when you need to scale into your trade.

Knowing when and where to go in strong or ease takes patience and a keen eye.

Two ways order sizing helps you maximize profits

Being ‘ahead of pace’ isn’t considered a positive if you exhaust your energy reserves and can’t finish. Likewise, staying with your ‘core base’ even if you’re falling behind isn’t bad if it means you’re preserving capital. The goal in the end is to finish the race.

When managing a trade you can simply determine whether you should sprint or ease by your confidence in the conditions: Do you have multiple confirmations that a swing is imminent? Are you at a pricing extreme that’s showing exhaustion? Where are you in relation to the value zone?

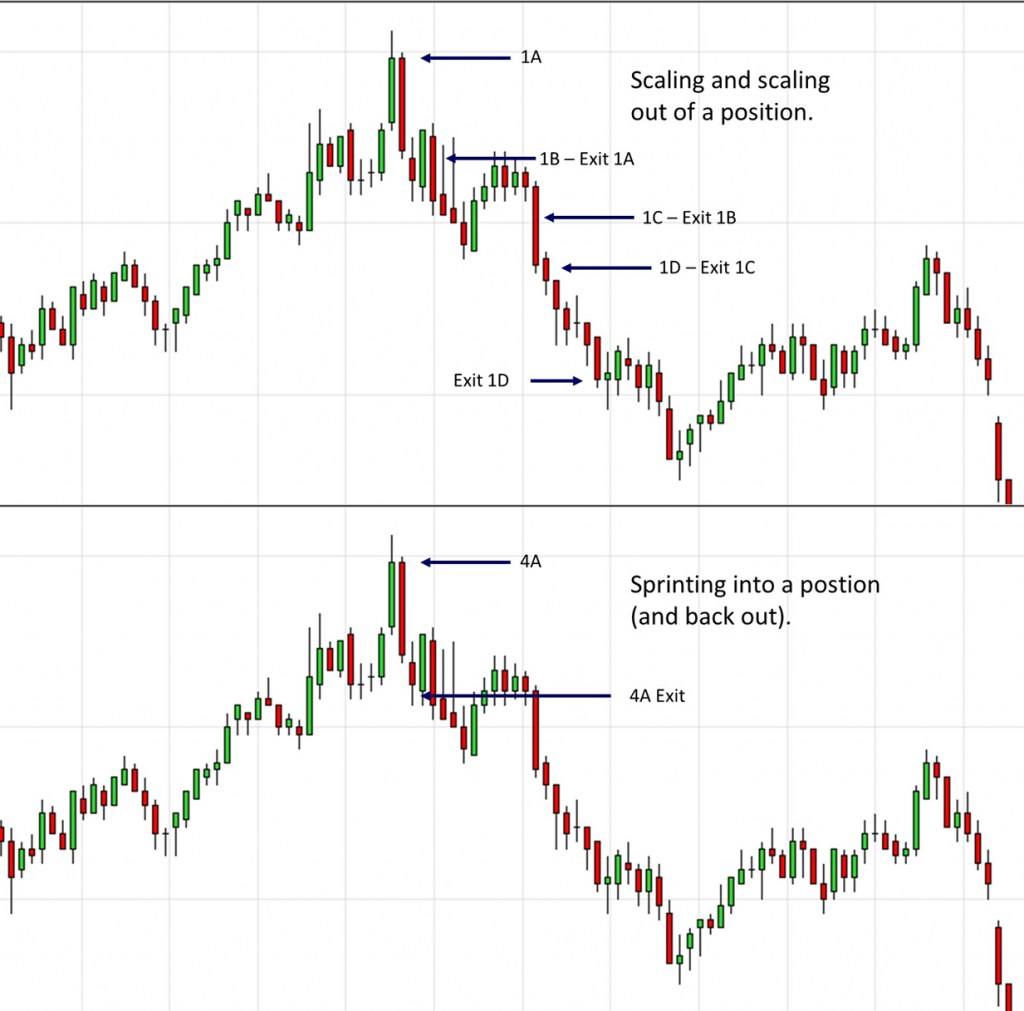

If you’re confident, but have reservations — scale into the trade. Simply take one contract and additional positions as the price advances in your direction. In scaling into a position, you’re essentially taking a stair step approach. If price goes against you, you have the flexibility to back away from the trade.

If you’re ‘hold your hand to the bible’ sure — sprint. That is, every confirmation box is checked — assume more than one contract. Keep an eye on volume and the RSI (relative strength index) — if they show signs of wavering or reversing be prepared to get the hell out of that trade. With multiple contracts, you can live with shorter time frames — so don’t be bashful about taking your profits in short order.

Whatever approach you take in the marathon or the market, DO NOT assume a position with multiple contracts in pursuit of your goal. Just like any race, the determination should be made based on location conditions — so that you can finish the race.

The advantage of having order size options

Many traders choose to go with the same order size regardless of the circumstances. Depending on your trading style and risk management plan, this could be absolutely the right approach for you. For instance, if you’re a beginner – or have a low tolerance for risk – you’ll likely be rolling with one standard order size — one. For advanced traders, you may find this limits your flexibility when working with a developing trend or reversal.

Being able to scale into a trade, taking profits along while mitigating risk allows you to take advantage of swings, while managing your exposure of an extended period of time. Sprinting for too long, under the wrong conditions can exhaust your capital before you’re ready.

Knowing you can sprint when you need to, allows you to seize opportunities when they present themselves. Closely managing the time you sprint will help minimize the exposure your entries face — while conserving your resources.

Have both ready to go and widen your options when contemplating an entry.

Run towards profits in any market you’re given

The great long distance runners are said to have a special skill for sensing when to hit the gas. Some of the most legendary ‘kicks’ have come after races where the runner has seemed to be out of the lead pack and out of the race.

Spot, don’t sense, the conditions to increase your order (or lot) size. When you see clear signs of a reversal, go for it — as long as you’re willing to accept the outcome and get out early. If you’re not sure about the magnitude of the swing, scale yourself in and build your position up. This will give you flexibility to back away or increase your foothold.

Pick your spots in the marathon of the market and win the race to profits over time.