Whether you like the food or not, McDonald’s is by far the most popular fast food restaurant in the world. It is also the most consistent in terms of the results they deliver to customers.

Wouldn’t it be nice to find this kind of consistency in a tool for projecting price moves in the futures market?

There is one. Ironically, it is also called a MACD. But traders who use the market MACD will be able to eat much better than a Big Mac and fries.

If you are ready to move on from fast food to faster winnings, read on.

What Is The MACD In The Markets?

McDonald’s is the trend-maker in the fast food business. We can learn a great deal about the overall direction of fast food by watching the actions of McDonald’s. One of the reasons for McDonald’s success is the consistency of their operations. Everything moves in close correlation to everything else. This consistency and reliability is what makes McDonald’s the most popular fast food business in the world.

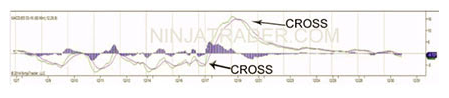

In the markets, the MACD is a price trend momentum indicator. When the lines cross, it tells smart traders that the price momentum is shifting in the market. Because the MACD is a price trend indicator it normally moves in a close relationship to the price. Traders can have a lot of success by watching the actions of the market’s MACD.

The consistency and reliability of the market MACD is what makes it one of the most popular market tools of traders. It is excellent at predicting price movements in the futures markets.

It allows traders to see changes in the short-term momentum of an asset price. When the two lines cross, it indicates a coming change in price movement in the

direction of the crossing lines. The MACD will display the crossing of the two averages and also show the direction of the crossing with bars emanating from the centerline of the graph.

Why Does It Matter When Divergence Exists In The Market?

But even one of the favorite tools of successful traders is not perfect.

The MACD and the price of the asset it underlies should move in concert with each other. This is because the MACD is a combination of short-term average prices of an asset. But that does not hold true 100% of the time.

When price moves and averages that are necessarily tied together move in opposite directions it is called a divergence. This condition occurs but will not normally last.

Asset prices moving in the opposite direction of the MACD warn successful traders to keep a close eye out for price reversals. The longer the divergence exists, the stronger the correction is likely to be.

A falling asset price and a rising MACD cannot coexist for long. Like a Big Mac and an order of fries in front of a hungry diner the divergence in the market MACD can disappear in a hurry when the trend lines cross.

Divergence matters to traders because we know the condition will correct. If your trades are in the way when it does, look out below. Either the MACD or the price must correct and change direction.

Trading software allows traders to clearly see these divergences between price and the MACD developing. When you see them, you know they will correct. You also want to be sure your trades are not in the way when they do.

The second step experienced traders take is to win from the correction. Just like a car flying through the air, the greater the divergence in the market, the greater the risk and opportunity.

How Do We Benefit Right Now?

Trading programs that can display the MACD and price charts together make divergences between these two metrics easy to find and view.

When things normally move together, and suddenly move in opposite directions, the divergence will correct. Knowing what divergence is and how to identify it, allows you to protect your trading account from risk.

You cut your risk by exiting positions where divergence exists… or watching them very closely. Exiting them eliminates the risk. Watching them closely still allows you to succeed from the growing divergence while waiting for the correction to begin.

After the correction of a divergence is underway, you can then place orders that will win as the divergence is corrected.

And with the kind of rewards trading divergence corrections will put into your trading account, you’ll probably want to super-size that happy meal.