If you were watching the men’s 100-meter sprint at the 2013 U.S. Outdoor Track & Field Championships you would have thought you were backwards. The sprinters were running in the opposite direction from normal.

The USATF officials had assessed the prevailing wind conditions and decided the wind was too strong to run against. After a minute or so, they decided the sprinters should run in the opposite direction from normal.

Had they just started the race without checking the prevailing conditions, the performance of the sprinters would have been very poor. Likewise, traders who will take just a minute to check the market headwinds before trading can also avoid poor performance as a result of running against the wind.

Why You Should Check The Market Wind Before Trading

You are perched at your terminal waiting for the market to open so you can get a fast start to the race. As soon as the gun sounds, you break out of the starting blocks. You have just made your first mistake of the day.

Experienced runners in the futures market know the first thing to do when the gun sounds is assess the headwinds. They don’t want to risk their trading capital by running against the headwinds in the market. They wait for the market to set the parameters for them.

Isn’t it worth 1 minute at the start of your trading session to find out where the headwinds are that could slow you down all day?

How Do You Find The Market Headwinds In Just One Minute?

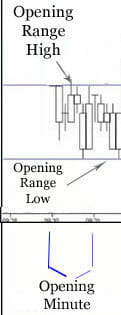

The opening range in the market is a useful tool available with many of today’s trading systems. It identifies the high and low prices established during the first 60 seconds of trading each day.

If you don’t have a trading system that offers this tool, it is easy to create it yourself. It only takes another minute to do it. Simply draw horizontal lines across the chart at the high and low prices reached in the first minute of trading.

Having software that does it for you is easier, but it is not as hard as you might think to do it yourself. It is also well worth the time it takes.

This 60 seconds can make your day.

Where Is The Opportunity For Retail Traders?

The opening range tool provides two valuable benefits to retail traders.

First, it keeps you from jumping right into a trade at the open without having any idea as to which direction the wind is blowing. Don’t think for one minute that the market pros won’t pick off your order and then move the market where they were going to go anyway.

The second benefit retail traders can realize from the opening range tool is gaining a visual picture of attractive entry points for trades. When the price bounces off the established support of the opening range low, a buying opportunity is being signaled. Now it is time for retail traders to enter the race.

The first minute of trading establishes the initial trading range for the market. When it tests one of these levels and fails to break it, the market is signaling opportunity.

How Do You Know When The Wind Direction Changes?

The opening range is an excellent tool for retail traders. Watching the top and bottom ranges can help determine which way the wind is about to blow. This knowledge can provide indication when to open a position.

The opening range is excellent for establishing which direction the wind is blowing at the open. It provides indications of excellent opportunities for opening trades.

As with any tool, the opening range is most effective when used in conjunction with other tools. It can show us the direction of the market wind. It can also show us when that prevailing wind is gaining strength though a breakout of the opening range. Where it is not as useful is showing us when the market wind is changing directions.

We know that the winds of the market will change direction at some point. Once you get the wind at your back you can use trend lines to track the market wind direction and show you when it is changing.

Using trend lines in conjunction with the opening range will allow you to protect the winnings that the opening range helped you produce. Now you are also protected when the ill winds start to blow against you.

Trade With The Market Winds And The Rewards Will Blow You Away

Taking that extra minute at the start of trading to find which way the wind is blowing can be the most valuable minute of your day. It is that decision that can lead to better winnings every other minute of the entire day.

It is always important to be aware of directional changes in the market winds, and retail traders need to monitor those winds carefully. It is always important to protect your trades and not allow an ill wind to blow your winnings away.

Now that you know how to run with the trade winds of the market, you can start using the opening range today. It will keep the wind at the back of your trades and cause your account balance to run higher, faster.