It measured 9.0 on the Richter Scale. Japan’s largest earthquake in recorded history. The quake and the 30-foot walls of water from the following tsunami would take hundreds of lives and wreak massive devastation.

If you thought that the effects would be limited to Japan’s eastern coast when reading about this in the comfort of your living room – you were mistaken. This seismic event literally shook the universe. The earth would ‘twitch’ in recoil with lasting effects felt as far as Antarctica in the coming months.

Every day, there are news events that shake the market with varying levels of magnitude. There are those that create tidal waves of unpredictable activity in the form of unscheduled, unexpected news.

But there are also events which generate volume that’s equally volatile, that you can plan for and profit from. These are the scheduled events that take place around the world every week.

With proper planning and discipline, you can harness the aftermath of these results – good or bad – for a profit.

News you should watch that rocks the market

Scheduled news you can profit from can be broken into two categories:

- World Events: Arranged statements from major world banks and institutions (like the Federal Reserve). These usually directly reflect the strength and health of a given market or zone. Their impact can be found across futures, Forex and stocks. Examples include:

- Interest Rate Announcements

- EuroZone & Federal Reserve Committee Minutes

- Central Bank Statements (Bank of England, Bank of Japan, etc.)

- Stock Events: Scheduled releases from exchanges and publicly-traded companies reporting performance and health. Examples include:

- FOMC (Federal Open Market Committee) Statements

- Earnings Announcements

- Press Releases

Unlike unscheduled events you can watch for these releases and expect price to fluctuate in response to the news. Profiting from them is a matter of preparation and discipline. You can get yourself started by knowing where to look in the first place.

Get a heads-up before any market storm hits

7,500+ miles away from Japan’s east coast, the U.S. National Weather Service issued tsunami warnings for at least 50 countries and territories.

Like the National Weather Service, there are a number of free resources that will give you a macro view of upcoming events. These sites also provide prior performance, consensus forecast and the actual results – the second they are released.

You can find all scheduled world events at a variety of sites. For futures, the CME Group has an extensive calendar under the education tab on their site. Bloomberg has an equally extensive calendar under the markets tab. FXStreet and Forex Factory also list scheduled world events, complete with countdown timers and real-time reporting.

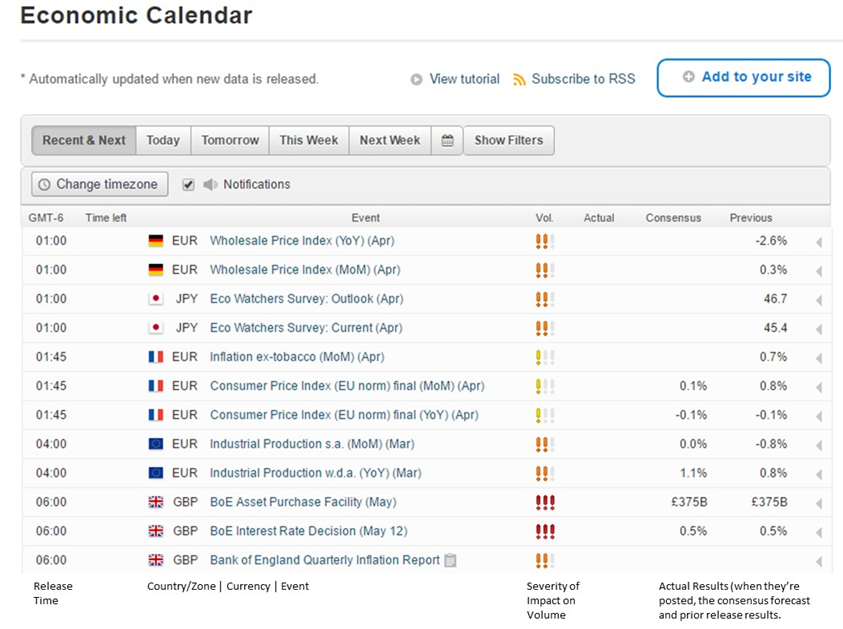

Check out the ‘economic calendar’ tab and you’ll find all upcoming major events, along with their respective country/zone, release time and severity of impact.

With one quick visit, you’ll have every upcoming major world economic event, that’s scheduled.

As an example, here is a snapshot of what you’ll find – see the screenshot from FXStreet.com to the right.

Stock events can be tracked through any number of sites, also free, giving you a comprehensive look at a particular company or offering. Yahoo! Finance, Bloomberg and E*Trade will give you:

- Company events – past, recent and upcoming

- Press Releases

- Recent News stories

Now that you know where to get the scoop, let’s use this information to profit.

Immediate price volatility that everyone feels

Imagine an event so violent it can be felt across the world. Japan’s earthquake set off tremors in Nebraska.

Major news events attract volume and the results create volatility that challenges fair price – with no boundaries or distance constraints. In a matter of minutes, you can expect price to break through multiple levels of either support or resistance – depending on the news.

Note the impact on price and volume with the below release of NFP (Non-Farm Payrolls), one of the most anticipated economic releases of the month. Immediately upon release of the 8:30 EST news, you’ll see that:

News arrives generating price volatility that leads to opportunity.

- Price rockets out of the narrow zone it had been trading in leading up to the release. Typically, value zones will constrict as volume dies down in anticipation of the news.

- As the market deals with the news over the course of the following 15 minutes, price oscillates wildly – touching an out-of-range high.

- Volume explodes, basically pouring gas on the volatility for this period.

Setting aside the actual NFP results, you can see the clear impact it had on price over the span of 20 or so minutes. This volatility is profit opportunity.

Knowing these events are on the horizon will position you to research in advance and profit. Assuming they won’t affect you will make your trade a sitting duck.

Making your entry without getting wiped out

Tsunami-like news can either boost your profits or wipe you completely out.

In our example, as with many news events – your opportunity to profit DID NOT come with a bet placed during the pricing extremes. Playing with volatility of this nature without insight is a great way to clean out your account.

Attempting to predict the news can be equally devastating, regardless of how solid you believe your advice may be. Consider this: Non-Farm Payrolls so far this year have only come close to the consensus estimate once. Three of the five months have been off by 20+%. Betting on a surge or plummet would not have been a good idea.

Instead, experienced traders will often fade the news. As volume recedes and volatility dies down, you’ll see that price returned to a familiar value zone in our example. You can spot this as institutional forces push the candles back, creating long tails that leave traces of the volatile price extremes that didn’t hold.

Get wiped out during pandemonium, or profit from it.

Let the market react over the course of 5-10 minutes’ time – depending entirely on the news. This often presents an opportunity to enter as the dust settles.

Get wiped out during pandemonium, or profit from it.

Turning scheduled news events, good or bad, into profit

Unlike the victims of a natural disaster, you have the benefit of advance warning and foresight when dealing with scheduled news events. Regardless of the results being reported.

Understanding the potential impact of a news event, scheduled or unscheduled, is the difference between profit and loss for many amatuer traders. Focusing on scheduled events, and anticipating their impact on price allows you to position and profit. Ignoring their arrival leaves you completely unaware and exposed.

Take advantage of the free tools available to you to track these events as they unfold. Monitor the build-up to major events and the resulting impact on price and profit. Enter after the market has responded and the long tails of the candles signal receding flood waters.

Profit from the impact and aftermath of scheduled news, not the initial havoc that it creates.